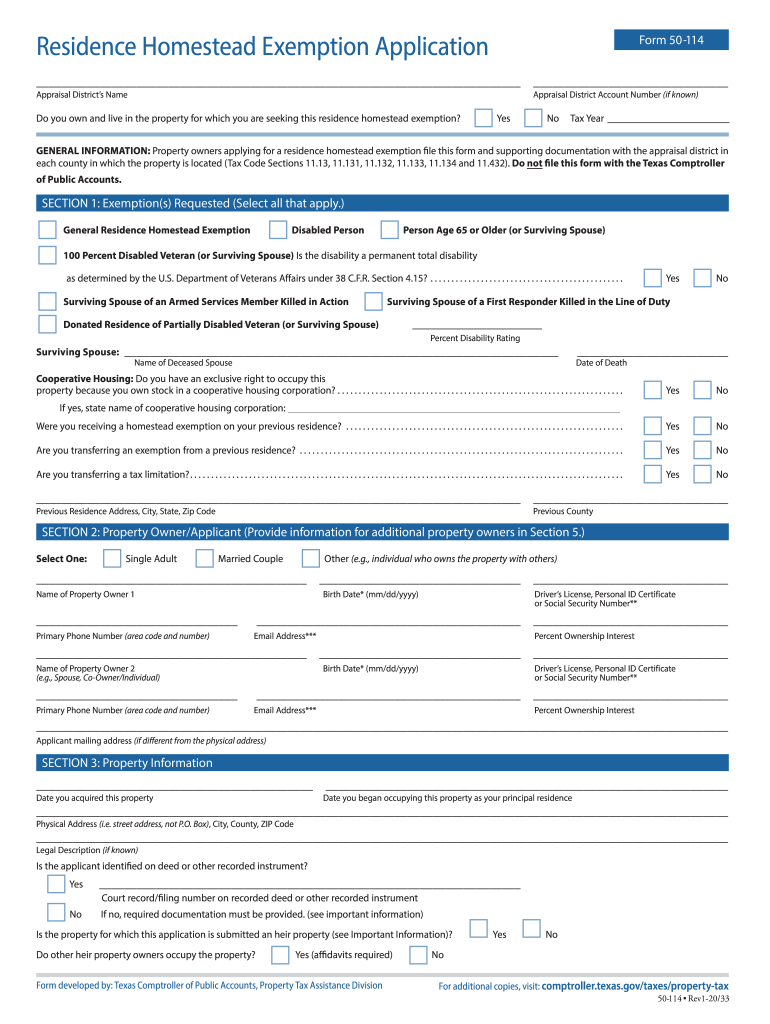

Tarrant County Homestead Exemption Form 2025

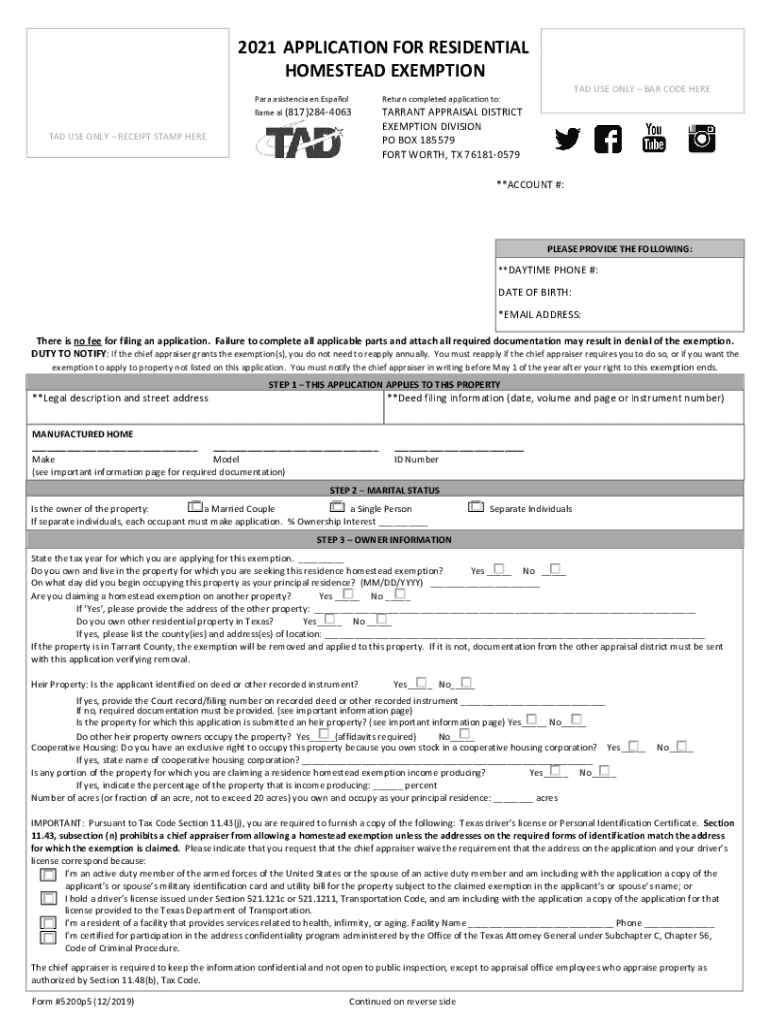

BlogTarrant County Homestead Exemption Form 2025. “bills on accounts with a qualified homestead exemption will reflect the. To read more about exemptions you may.

In order to qualify for this option, the property (1) must be your residence homestead, and (2) must have an over 65 exemption; Tarrant county commissioners court approves homestead exemption for county and jps hospital district for the first time by frank heinz • published june 9,.

Effective january 1, 2025, a qualified property owner may claim the residence homestead exemption as of the date that they own and.

Tarrant county homestead exemption form Fill out & sign online DocHub, In order to qualify for this option, the property (1) must be your residence homestead, and (2) must have an over 65 exemption; The texas homestead exemption laws for 2025 saw some significant changes thanks to proposition 4, passed by voters in november 2025.

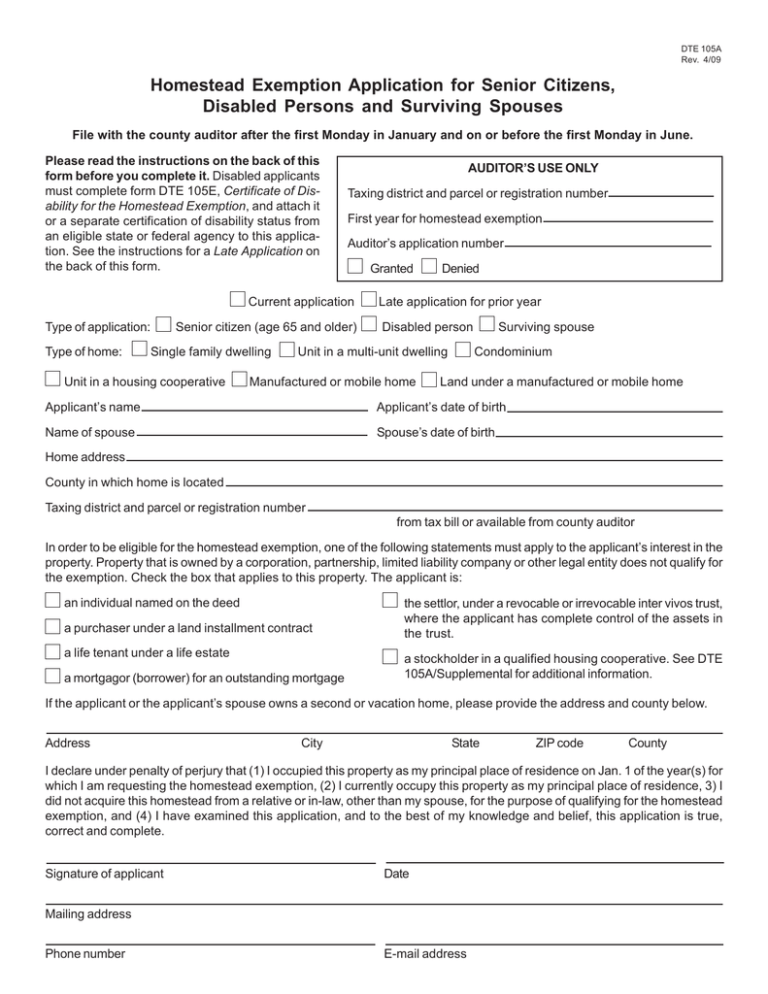

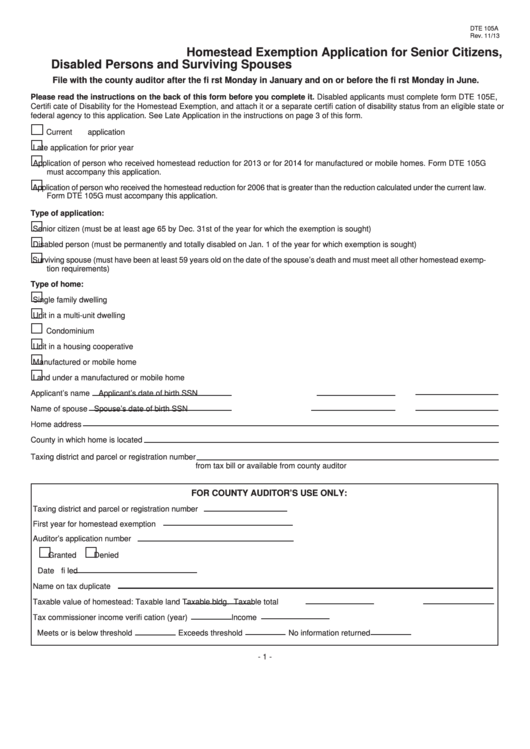

Homestead Exemption Application for Senior Citizens, Disabled Persons, Tarrant county homeowners will get further tax relief this year amid skyrocketing appraisals, after county commissioners approved the creation of two new. Effective january 1, 2025, a qualified property owner may claim the residence homestead exemption as of the date that they own and.

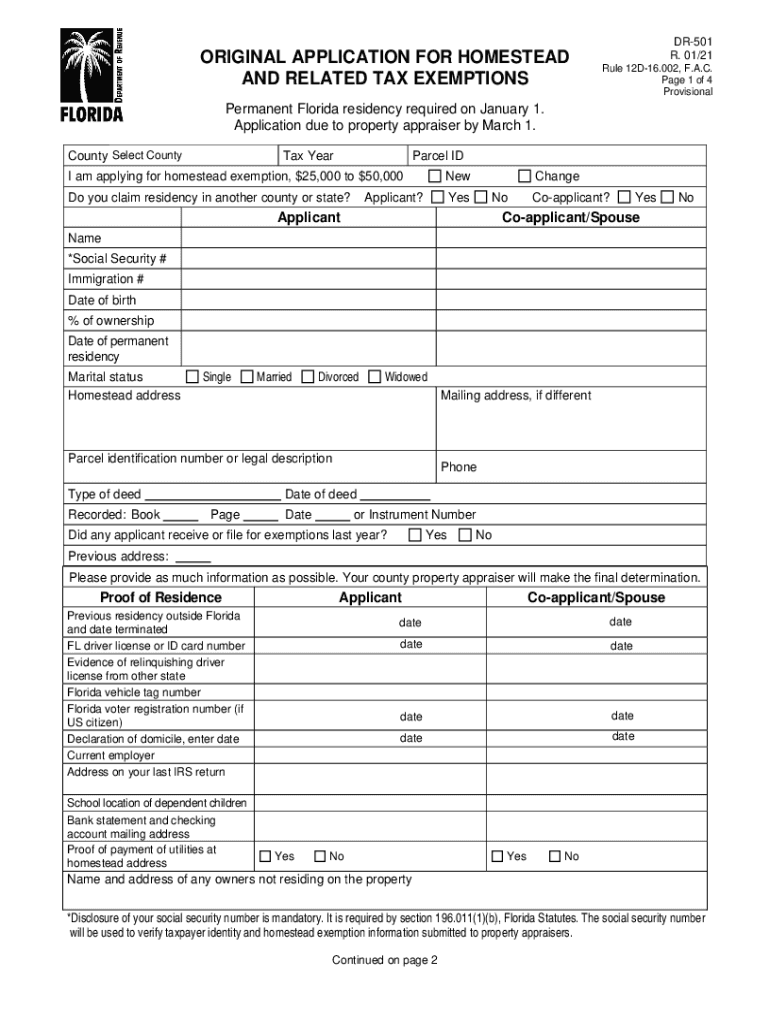

Homestead Exemption Florida Deadline 20212023 Form Fill Out and Sign, How do i know if i have an exemption? Under property search, type in your home.

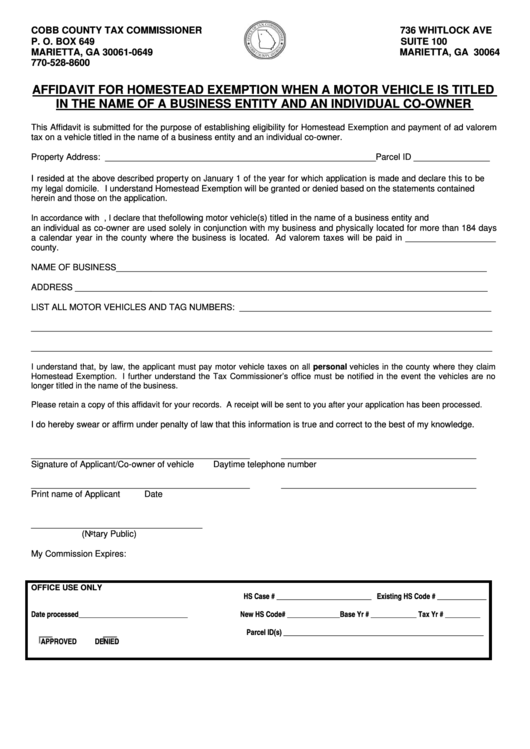

Fillable Affidavit For Homestead Exemption When A Motor Vehicle Is, In order to qualify for this option, the property (1) must be your residence homestead, and (2) must have an over 65 exemption; Tarrant county homeowners will get further tax relief this year amid skyrocketing appraisals, after county commissioners approved the creation of two new.

Fillable Affidavit For Homestead Exemption Form Printable Pdf Download, The texas homestead exemption laws for 2025 saw some significant changes thanks to proposition 4, passed by voters in november 2025. In tarrant county, visit the county appraisal district’s website at www.tad.org.

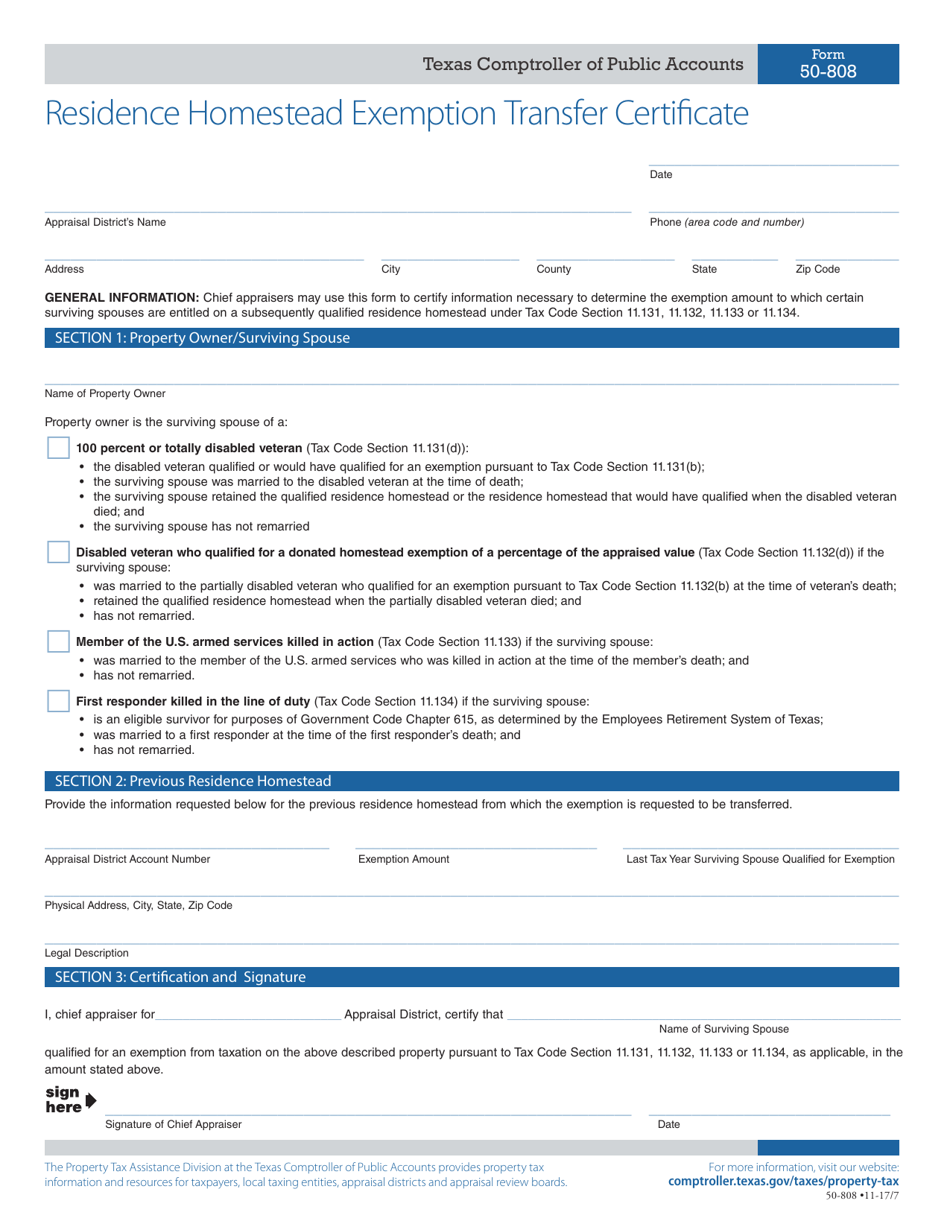

Homestead Exemption, To apply for a homestead exemption for a property in tarrant county, you can submit an application form to the tarrant appraisal district by mailing it to po. Tarrant county homeowners will get further tax relief this year amid skyrocketing appraisals, after county commissioners approved the creation of two new.

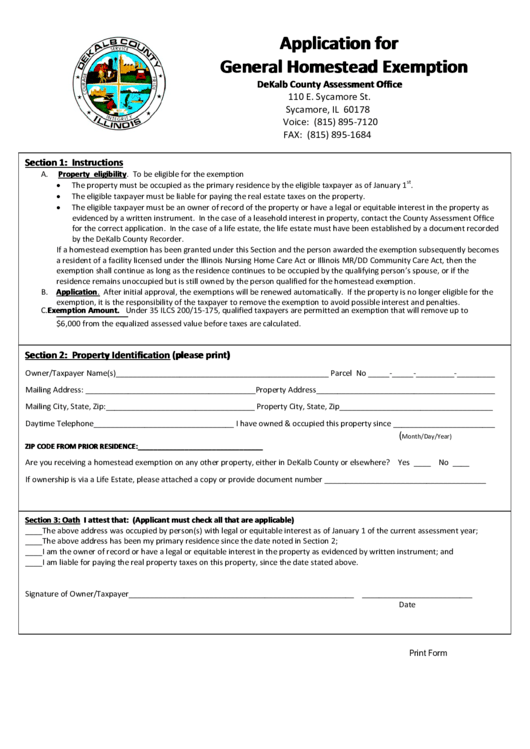

Fillable Application For General Homestead Exemption printable pdf download, As required by senate bill 1801, the tarrant appraisal district is verifying homestead exemptions across the county. Under property search, type in your home.

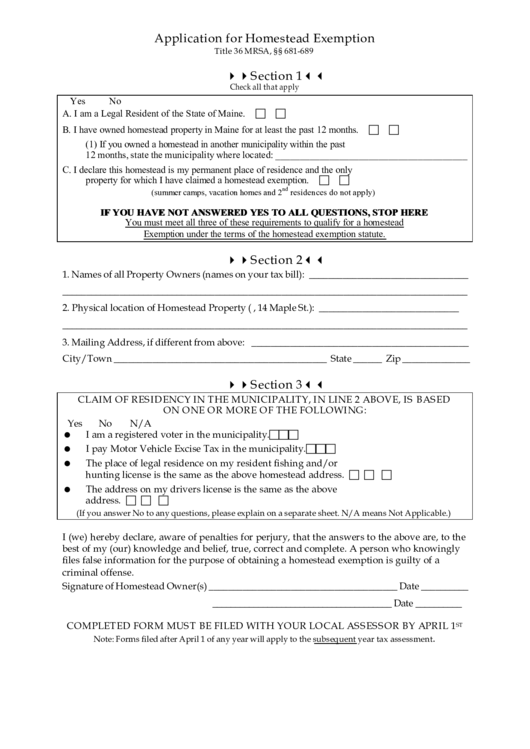

Fillable Application For Homestead Exemption Template printable pdf, Tarrant county provides the information contained in this web site as a public service. To read more about exemptions you may.

Brazoria County Homestead Exemption Online Form Fill Out and Sign, Restricted use timber land appraisal: Effective january 1, 2025, a qualified property owner may claim the residence homestead exemption as of the date that they own and.

Fillable Online Homestead Exemption Tarrant County Form. Homestead, To read more about exemptions you may. Under property search, type in your home.

Tarrant county homeowners will get further tax relief this year amid skyrocketing appraisals, after county commissioners approved the creation of two new.

In order to qualify for this option, the property (1) must be your residence homestead, and (2) must have an over 65 exemption;